what is the property tax rate in dallas texas

Web When compared to other states Texas property taxes are significantly higher. DFW Dallas Fort Worth Property Tax Rates.

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Web Dallas establishes tax rates all within Texas constitutional directives.

. Web The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. Web 14 hours agoThe top 1 percent of earners in Texas pay dramatically less. Web Tax Rates and Levies.

214 653-7888 Se Habla Español. Even then taxes can only be postponed so long as taxpayers live in the property. Be Your Own Property Detective.

Web Find Property Tax Rates for Dallas Forth Worth. Texas Property Tax Assistance 888 743-7993 Customer Service 972 233-4929 all states. Free Utility Connect Concierge Service.

Dallas County collects on average 218 of a propertys assessed fair market value as property tax. While Texas property taxes are over 57 higher than most states the state compensates by not charging state or personal income tax. Web What is the property tax rate in Dallas County.

214 653-7811 Fax. Web The median property tax also known as real estate tax in Dallas County is 282700 per year based on a median home value of 12970000 and a median effective property tax rate of 218 of property value. Web The average property tax rate in Texas is 169 against a national average of approximately 107.

Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of. The present market worth of real estate located within Dallas is estimated by county assessors. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Web The minimum combined 2022 sales tax rate for Dallas Texas is. Web 1 day agoStalled cars sit abandoned on the flooded Interstate 635 Service Road on Monday in Mesquite Texas. Did South Dakota v.

Web Property Tax FAQs Tax Rates Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. Assuming that that rate does not significantly change the average homeowner in Dallas County can. 31 percent of their income vs.

Taxes are considered regressive when they take a larger percentage of income from low-income. Texans in the top 1 percent earn 617000 or more per year while Califrnians in the 1-percent-club earn 714000 or more. Toggle navigation DCTO Left.

As of the 2010 census the population was 2368139. Texas Home Warranty Companies. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Dallas County Tax.

Compare by city and county. The tax rates included are for the year in which the list is prepared and must be listed alphabetically according. On top of that the state sales tax rate is 625.

Search Any Address 2. Web Find out who bills and collects taxes for the City of Plano and view local tax rates. This is the total of state county and city sales tax rates.

Web First you must secure a Homestead Exemption before a property tax payment suspension can even be requested. Dallas County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

But a notice published in the El Paso Times by the city shows the average taxable. Web The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. We urge our customers to take advantage of processing their Motor Vehicle Transactions and Property Tax Payments online at this website.

Ad Need Assistance Paying Your Texas Property Taxes. According to the Tax Foundation that makes the overall state and local tax burden for. DALLAS Heavy rains across the drought-stricken Dallas-Fort Worth area on Monday caused.

The Dallas sales tax rate is. Dallas has a 193 property tax rate against a 161500 mean property value. Ad Find Dallas County Online Property Taxes Info From 2022.

At a recent presentation staff in the countys budget office presented four possible. The County sales tax rate is. Web 2016 Tax Rates.

Nevertheless interest around 8 percent together with late payment charges still adds up and is collectible. Web 11 hours agoCity staff came back with an 862 cent property tax rate which is about a 5 decrease from the year prior. Web Dallas County is a county located in the US.

124 percent in California. See Property Records Tax Titles Owner Info More. Web Learn about Dallas property tax rates homestead exemption Dallas Top Realtor and Dallas Luxury Home Realtor Real Estate Agent What is my Dallas home worth.

While the national average tends to fall between 108 and 121 Texas average effective property tax rate is above 183. We Will Pay Your Residential or Commercial Property Tax Bill in Full. Maintenance Operations MO and Interest Sinking Fund IS Tax.

The Texas sales tax rate is currently. For comparison the median home value in Dallas County is 12970000. Texas Mortgage Interest Rates.

However left to the county are appraising property mailing billings bringing in the tax conducting compliance programs and clearing up discord. Find Your DFW Mortgage Lender. The average property tax rate in Dallas County is 218 of assessed home values.

Web We have the info you need to pay property taxes in Waller County and find a Waller County property tax loan from a top Texas lender. Contact ARG Realty LLC. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes.

This is significantly higher than the Texas state average of 181 and nearly double the national average of 11. Search For Title Tax Pre-Foreclosure Info Today. Web 2 days agoThe current property tax rate for the county is 2279 cents per 100 of assessed valuation a ten year low.

Tax Code Section 5091 requires the Comptrollers office to prepare a list that includes the total tax rate imposed by each taxing unit in this state as reported to the comptroller by each appraisal district. Searching Up-To-Date Property Records By County Just Got Easier. Wayfair Inc affect Texas.

Property Taxes By State Embrace Higher Property Taxes

Property Tax Comparison By State For Cross State Businesses

How To Slug It Out With Your Governing Bodies Over Property Taxes

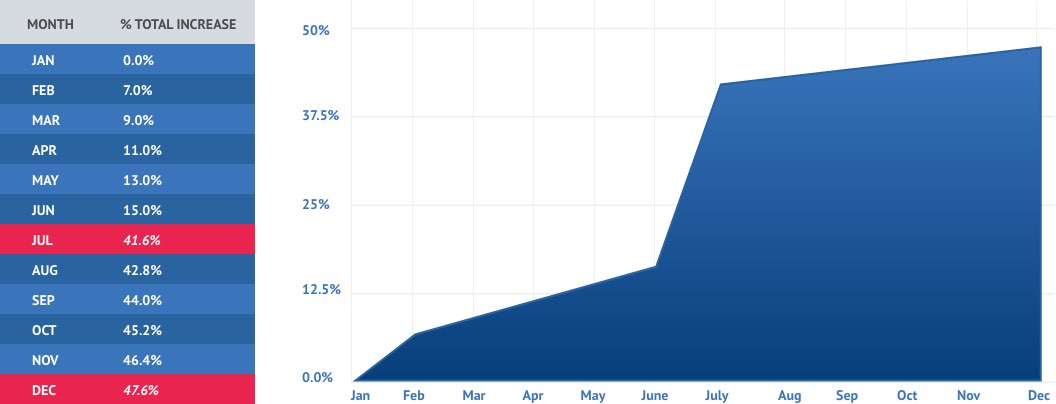

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Breaking It Down This Is How The New Texas Property Tax Law Affects You

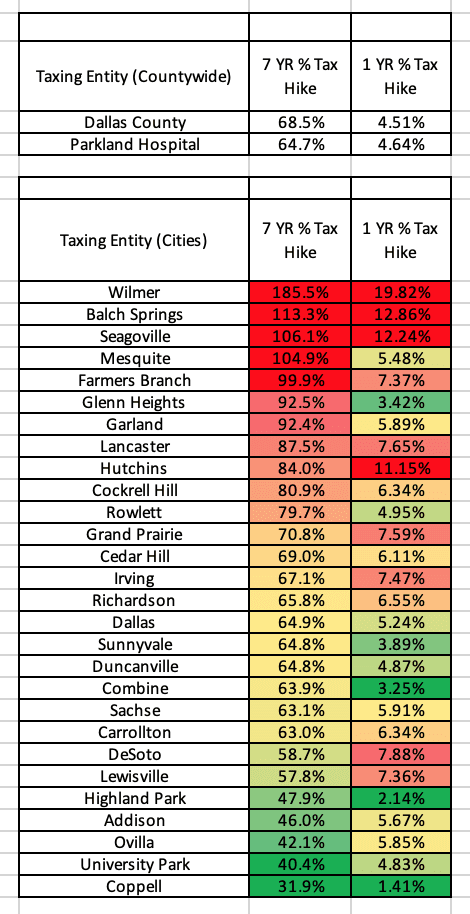

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Which Texas Mega City Has Adopted The Highest Property Tax Rate

How To Slug It Out With Your Governing Bodies Over Property Taxes

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Property Tax Comparison By State For Cross State Businesses

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Why Are Texas Property Taxes So High Home Tax Solutions

Property Taxes By State Embrace Higher Property Taxes

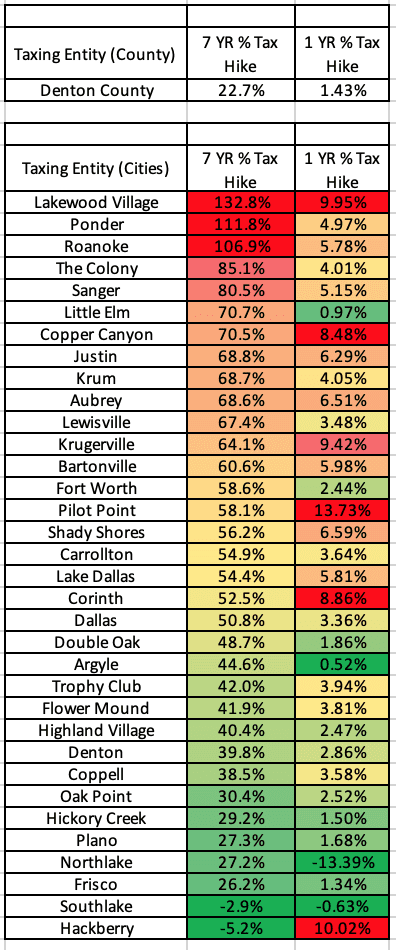

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key